2026 Men’s Denim Switching Map: Which Brands are Winning Customers & How

New data reveals a structural break in the denim retention model: Gap and Old Navy gain on "consistency" as legacy brands leak on "durability doubt".

NEW YORK, NY, UNITED STATES, February 10, 2026 /EINPresswire.com/ -- Men’s denim used to be the industry’s "safe harbor." For decades, C-Suite executives viewed it as a high-LTV (Lifetime Value) category defined by entrenched habits: a customer found their fit, bought their brand, and stayed put. The prevailing wisdom was that denim was a simple replenishment business: once you won a customer, you owned them for life.But in 2026, that instinct is increasingly wrong. The category's stability is fracturing. The driver isn’t a shift in taste, a new silhouette, or a viral trend cycle. It is a collapse in tolerance for operational variance.

According to Clootrack’s latest Voice of the Customer (VoC) analysis of the U.S. men’s denim market, loyalty is no longer defined by who has the best brand story. It is defined by who creates the least anxiety at checkout. In the current retail environment, "Fit Consistency" is no longer just a satisfaction metric - it is the primary driver of switching intent.

Clootrack is the Voice of Customer analytics platform recognized by OpenAI last year for crossing 100B tokens.

The New Metric: Net Flux vs. Sales Lag

Backlash and buzz are easy to see, but silent defection is harder to track. Quarterly sales reports and return rates are lagging indicators: they only tell you who defected three months ago. To identify churn risk before it impacts the P&L, Clootrack analyzed Net Flux: a directional signal calculated by tracking inbound brand switches minus outbound switches in customer conversations. This metric captures the moment hesitation resolves into action. When analyzing over 55,000 conversations, the data revealed a massive redistribution of trust flowing away from legacy equity and toward operational safety.

The 2026 denim brand switching map: who’s gaining loyalty and who’s leaking it?

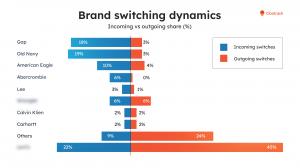

Across the mass-market leaders, Net Flux highlights a sharp redistribution of customer movement:

- Old Navy: +66 Net Flux (Gaining)

- Gap: +65 Net Flux (Gaining)

- Levi’s: –99 Net Flux (Leaking)

This isn’t a style cycle. It’s a flight to safety. Here is how the buying logic has changed for the C-Suite.

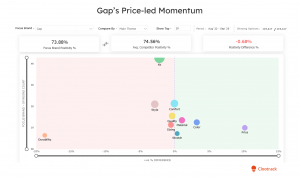

Rule #1: "Safer" Beats "Sexier" (And Reduces CAC)

Gap’s resurgence (+65 Net Flux) challenges the usual branding playbook. Growth here isn’t coming from novelty; it’s coming from de-risking the purchase. In the category comparison, Price is Gap’s clearest positive advantage versus competitors, while Fit is a high-volume conversation with slightly lower positivity than the category average (and durability is the most obvious drag). That combination is revealing: customers aren’t raving about “cool” product moments - they’re choosing Gap because it feels like the safer bet on value, even as fit consistency remains a watch-out.

The Business Impact: This “safety” positioning improves effective CAC efficiency by reducing post-purchase friction. In online apparel, where returns are structurally high and often driven by fit/expectation gaps, brands that signal predictable value convert more “hesitant” traffic into kept orders, not just orders. That means fewer dollars wasted on reacquiring the same customer after a disappointing first purchase, and better ROAS because more of what you acquire actually sticks.

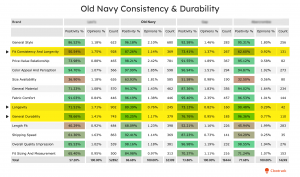

Rule #2: Consistency is Margin Defense

Old Navy’s surge (+66 Net Flux) proves a critical lesson for 2026: You don’t need a cultural moment to win market share. You just need to survive the "product reality check". Attention brings the trial wave, but execution decides who stays. Old Navy is winning because it is successfully eliminating the two most expensive failure modes in the apparel P&L: returns due to unpredictable sizing, and defection caused by premature wear. In our benchmark analysis, Old Navy set the standard for the metrics that actually drive retention:

- Fit Accuracy: 4.10 / 5 (Highest among leaders)

- Body-Type Coverage: 3.84 / 5

- Durability: 3.48 / 5

This is execution acting as margin protection. By locking down consistency, Old Navy is protecting gross margins that other brands are losing to reverse logistics and re-acquisition efforts. Consistency isn’t invisible to customers; it is the primary reason they convert trial into habit.

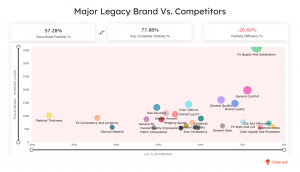

Rule #3: Durability Doubt Kills Equity at the $75 Threshold

The steep decline of a popular legacy brand (–99 Net Flux) offers a warning about the fragility of legacy. The outflow of customers isn't due to a dislike of the brand’s image; it clusters around recurring friction themes, particularly "thin-fabric perception". For merchandising leaders, the data identifies a specific financial "danger zone": the $75–$100 mid-premium band.

The consumer's willingness to pay this premium is anchored in material quality and finish. When customers perceive "shrinkflation" in fabric quality, where the fabric feels thinner than expected, the value proposition collapses. This price band behaves like a trap door. The data shows that once this "trust contract" is breached, the customer does not trade down within the brand; they exit entirely. Brand equity can absorb a single miss, but repeated inconsistency erodes it.

The Conclusion: The Funnel Has Changed

The most revealing signal in the market right now isn’t which brands are growing their social following. It’s how quickly customers move on once predictability breaks. For leaders in Strategy and Customer Experience, the mandate for 2026 is to pivot. We must stop viewing "consistency" as a backend operational KPI and start viewing it as our primary marketing asset. The funnel has changed: Brand equity creates the consideration, but product execution (sizing consistency, fabric weight, durability) dictates the retention. The brands that can make their predictability visible will win the trust of the risk-averse consumer.

Methodology

Clootrack’s findings are based on the analysis of 55,287 anonymized Voice of the Customer conversations across major U.S. apparel brands, from Q4 2022 to Q4 2025. Brand switching is identified through explicit customer statements indicating brand trial or movement. All reported figures are directional indicators derived from consumer conversations and do not represent verified sales, revenue, or market share.

VoC Research

Clootrack

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.